How to build a Defensible Generative AI company: The SaaSification of AI

April 2023

This post will focus on early-stage Generative AI startups building B2B applications. Infrastructure startups (LLMOps: MLOps for Large Language Models) are not part of the scope of this post.

"Saasification of AI"—(a new term coined by me, ha!) refers to the shift away from relying solely on technical defensibility, as a result of the widespread availability of Foundation Models APIs to the more commercial/business facets of defensibility.

Generative AI startups are operating in one of the most competitive spaces of our time. One of the common questions I often get from early-stage founders is how they can build a defensible AI company in this crowded, noisy, and highly-competitive space despite the limited resources.

Here are some founder sentiments:

It has never been as noisy as it is today in the Generative AI space, and this will only worsen over time. There are over 450 generative AI startups (according to the NY Times), with about $2.6 billion invested. According to Pitchbook, "As of March 16, 2022, that space had about $612.8 million in funding. This year, its funding is roughly $2.3 billion." In the recent batch for YC’s demo day, the consensus among partners was that there is a disproportionate amount of AI startups.

Furthermore, Open AI has shown that a core part of its strategy is going up the stack and providing its capabilities directly to enterprises, as evidenced by its new rollout of ChatGPT plugins and announcements of its partnership with Bain.

"We can help separate the hype from the real-world application, bringing experience across the value chain and a deep understanding of our clients’ industries", Instacart, Shopify, Spotify, Notion, Microsoft, and several others, thereby, in some cases, making some startup solutions obsolete. Other Foundation Model startups, such as Anthropic and Cohere, have announced partnerships with companies such as Quora.

To be clear, I am a big fan of Open AI, as they have been a net positive for early-stage founders and have helped to democratize access to cutting-edge models for the wider startup community.

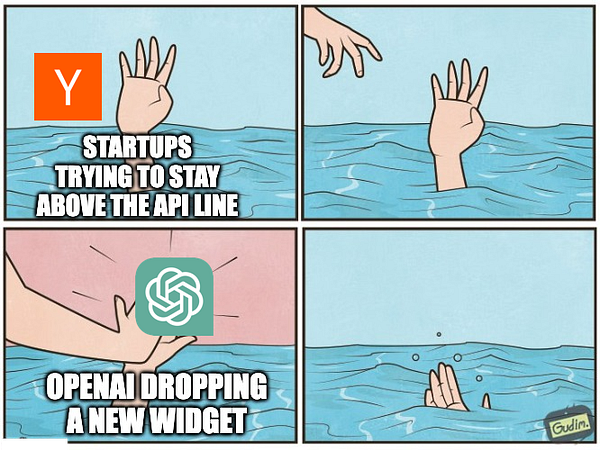

But I also found this meme quite funny:

In addition, there is significant competition from large incumbents such as Microsoft, Nvidia, and Alphabet. These incumbents have unfair access to scarce resources such as the best AI researchers, engineering, product, and GTM talent, massive distribution and customer relationships, large swatches of proprietary data, capital and large-scale compute resources, established reputations, and mind share. They have also shown a high speed of execution and a willingness to ship products quickly (for example, Microsoft and Alphabet).

In traditional AI companies where companies have to build the models from scratch, there was more of an argument that the technical defensibility (i.e., the technical expertise of the team, defensible IP) was paramount. However, in the Gen AI world, due to the ready availability of APIs via multiple Foundation Model players, I believe we are entering the SaaSification of AI, where other non-technical defensibility facets such as onboarding, etc. will play a disproportionate role in deciding who the winning startups are.

This post will discuss the 11 technical and non-technical factors to consider when evaluating the potential defensibility of a Generative AI company.

Technical:

Proprietary Data: For any AI company, high-quality data makes a significant impact on the accuracy of the model in delivering the outcome that it is designed to achieve. Having exclusive access to proprietary data within your domain can be a significant advantage, especially in specialized domains like healthcare. A strategy to build this is to focus on a niche (but high-value) domain and/or negotiate exclusive access to high-quality data. Alternatively, one may originally build this by first developing a "system of record," i.e., a product whose main utility is to help enterprises capture, store, and manage data related to a particular business activity such as human resources, accounting, compliance, etc. Several startups leverage this advantage; good examples are Aurora Solar and Tractable. However, it’s not just about having a large amount of data; the quality of the data matters far more. Another pitfall is that "Data Moats" are often not as defensible as people think (see A16Z article on "The Empty Promise of Data Another pitfall is that "Data Moats" are often not as defensible as people think (see A16Z article on "The Empty Promise of Data Moats").

A more efficient model: This refers to building or optimizing a model to be more cost-effective and efficient than alternative solutions. This can be a major advantage for early-stage startups, as one of the barriers to customer adoption is cost and ROI. With a cheaper operating model, you can offer a more affordable solution, improve your margins, and generally increase your runway as a company. For specific use cases within constrained environments (i.e., lack of internet connectivity) or latency-sensitive environments, this can make or break a solution. A good example of a company that leverages this advantage is Private AI.

Less data-dependent model: A pre-trained model that requires little to no data from a customer but can deliver business value and ROI from day one could be a major advantage. Most customers don’t want to go through the pain, cost, and liability risks to access the business value and ROI of an external AI solution. This is because the data sets are often incomplete and disparate, requiring significant effort and resources from the customer to "clean the data" and secure approval from their internal legal and compliance teams. Any solution that can circumvent this to deliver instant value to the customer without their proprietary data has a major advantage. This is partly one of the major reasons (among several others) that ChatGPT became a hit; you didn’t need to provide your data to gain solid value from it from day one.

A safer/ethical/compliant model: One of the major concerns of enterprises (and some consumers) leveraging Generative AI solutions is the exposure to ethical, societal, and legal liabilities. This is because AI solutions have been proven to have a significant bias (racial, gender, and several others) and unfairly leverage others' IPs (such as art) without the owner’s permission. Furthermore, in highly regulated fields such as consumer lending and insurance, there are explicit laws that prohibit the use of algorithmic solutions that discriminate against protected communities. For startups that can prove that their solutions are safer, more ethical, or more compliant than their competitor's, this could be a massive differentiator. A good example of this is Zest AI and Anthropic.

Non-Technical:

Open Source vs. Closed Source: Much has been written about the advantages of taking an open-source approach versus a closed-source approach. In AI, due to the fear and apprehension of the "black box", taking an open-source approach can be particularly advantageous, as it promotes transparency and flexibility, engenders trust with the developer community, creates community, and has all the other major advantages of open source. A good example of a company that does this very well is Hugging Face (though it’s not an application).

Niche Focus: This is one of my favorites because startups can gain an advantage from day zero by focusing on niche domains. The more "sexy" or "obvious" a sector is, the more competitive it becomes due to the attraction or focus of large incumbents, Foundation Model companies (Open AI, Anth), and several startups. This makes it difficult for your solution to stand out with customers, talent, and investors. A good approach is to focus on very narrow, ideally unsexy, domains with few or no startups and identify relevant Generative AI use cases. This provides several advantages, such as the absence of competition, giving you ample time to build a solid solution. Other advantages include:

It becomes easier to build a solid product and manage AI limitations

It can facilitate access to proprietary data (point 1) to improve the accuracy of your product

It provides the opportunity to further verticalize your solution to increase your TAM

It becomes easier to build and achieve significant mind share and brand recognition

It even creates a solid barrier that large incumbents cannot overcome once you’ve become the dominant solution.

Most successful applied AI startups take this approach, and it has been a formula for outsized success time and time again. The disadvantage of this approach is that some investors (not all) may be put off by the perceived "small" size of the market. However, many investors (including myself) love this approach and are actively looking for these types of companies, for example, Founder Collective.

Geographic Focus: Due to the change in the geopolitical environment and de-globalization, there has been a pronounced emphasis by sovereign nations on having critical technologies such as AI built at home, such as Aria, facilitating a "sovereign UK large language model." Startups can leverage this advantage to differentiate their solutions. Furthermore, in markets where the official language is not English, startups can create localized solutions for their core market. A playbook that has been used by several Chinese, Latin American, SEA, MENA, and African startups, i.e., Careem, Grab, etc. An AI example of this is Aleph Alpha, which is building "Europe’s Open AI."

Onboarding, Workflow and Change Management: This point builds on point 3, as the ultimate aim is to make it as easy as possible for the customer to access and get immediate value from your solution. Having an extremely easy onboarding process can be a major advantage as it requires little activation effort from the customer and end users, who are often unsophisticated technical users. Furthermore, change management is very important, as AI can be misunderstood outside of the tech sphere, so spending the time and effort to help the customers understand the limits of your solution—what it can or can’t do, how it directly impacts the metrics that they are trying to achieve, etc.—can be the difference between success and failure. A scalable way of facilitating this is to integrate the product into their existing workflow or a software package that they are already familiar with. The cons of this approach are that if your solution is easy to "rip out" for an alternative solution, then it can backfire as there are little to no switching costs.

Embedding/switching cost: This is the opposite of point 8 because the solution is hard to integrate and requires significant effort (and, in some cases, cost) for the customer to get value out of the solution. The question you may have is, "Why would anyone want this?" The answer, as you may have guessed, is that the pain and costs that the customer has incurred to install your solution create a barrier and high switching costs for them to adopt another solution that is not 10X better than your solution. Several older enterprise incumbents leverage this advantage, such as SAP. A quirky example of this is the Applied AI Company Samsara, which has been able to sign their small and mid-sized businesses to 3- to 5-year contracts, making it almost impossible for their customers to switch. This had the added impact of improving their margins while enhancing their defensibility.

Distribution Advantage: Startups can differentiate themselves by having some sort of "unfair" distribution advantage as they can scale quickly to become the dominant solution in the space. For example, founders or teams that have an established reputation and relationships with the major or most influential buyer (or users), partnerships that provide hard-won access to a significant population of buyers or end users, products that have virality or shareability built in, team members with strong community building expertise, or those with existing communities that are relevant, There are several good examples of this, such as Open AI, Stability, and MidJourney.

Regulatory advantage: Building on point 4, in some regulated industries, such as healthcare, regulatory compliance is a deal breaker for customers. Therefore, being able to secure and maintain access to hard-won and/or expensive compliance certifications can be a major advantage to the startup and a barrier to the competitors. The main disadvantage is the difficulty and cost of getting a hold of these certifications, which can be prohibitive for early-stage startups with limited resources.

Other well-known factors include network effects, scale, business model innovation, and the team’s execution speed and proficiency. I decided not to discuss these as I believe that they are well understood or do not apply to startups at their earliest stages.

To apply one or more of the factors to make your startup more defensible, you need to critically assess your startup to highlight which of these advantages are innate to your team and can be exploited. Most importantly, spend time with your customers to understand what they care about or prioritize when comparing similar solutions. This is extremely important because some of these advantages are irrelevant to them; for example, having a more compliant solution may be of little value to the average small to medium-sized e-commerce company.

I’d love to get your feedback on this; are there any I have missed or should include? Please let me know.

For further reading, check out:

Further reading:

The 7 powers of business strategy